At MDT Solutions, we work as your financial consultant from the moment we meet you, developing and deepening our relationship with you through the decades. We start by helping you hone, define, and refine your life objectives, so that you can solidify your understanding of what you want your money to do for you, whether your goals are for yourself, your business, or both.

Services at MDT Solutions

Whether you are mid-career, steadily saving and paying your bills, getting close to retirement, trying to save for your kids’ college, or maybe you are an entrepreneur or business owner trying to attract and retain quality employees, our services and strategies scale up or down to help you achieve your own personalized goals.

Personal Financial Coaching

Personal financial coaching is what we do with each client. In fact, at MDT Solutions, we work as your financial consultant from the moment we meet you, helping you define your goals and what you want your money to do for you. We examine your cash flow together, and explore strategies to take advantage of your taxable, tax-deferred, and tax-advantaged assets to help optimize your overall net worth and grow your multigenerational wealth.

Retirement Planning

Everything changes once you are no longer getting a paycheck—at that point you have to generate an income from your retirement savings. And keep in mind that if you have a large traditional 401(k) or IRA account, those savings will be subject to taxation whenever you take money out, as the IRS mandates that annual RMDs (required minimum distributions) begin at age 73. We help with retirement income planning, Social Security planning, tax-saving strategies, and much more.

Wealth Management

Wealth management encompasses your invested assets and retirement savings, seeking opportunities for growth while hedging against stock market volatility. At MDT Solutions, in addition to wealth management while you are working, we also help you consider your long-term plan for retirement, when many worry about outliving their retirement savings. We have access to tax-advantaged, limited distribution retirement income strategies that can last as long as you live.

Tax-Saving Strategies

Taxes are an important consideration at every age because it’s not just how much you earn, it’s how much you keep. If you don’t consider taxes, you could have much less wealth than you think. Especially in retirement, you may even end up paying taxes on your Social Security benefits if you have a lot of money saved in traditional 401(k) accounts, which you must start withdrawing and paying taxes on beginning at age 73. We emphasize finding ways to mitigate taxes no matter what your age.

Wealth Preservation & Protection

In addition to taxes, there are other risks that have the potential to derail your finances. The stock market could drop, or you could have an unexpected emergency, a health event, disability, or even a loss of life. We believe you should have protections in place for you, your family, and/or your business, so that should the unthinkable happen, you have financial safeguards in place. The goal is to shift risk away from you and over to insurance companies which exist to cover them.

Estate & Legacy Planning

If you have a family and/or assets, you need an estate plan. We work with estate attorneys to help you pass on a tax-advantaged legacy to your heirs and/or charities, documenting your desires for a stress-free transfer of wealth which can bypass probate. We can help you consider trusts and life insurance designed to maximize your legacy and help your family build multigenerational wealth. If you own a business, we’ll help you incorporate that into your plan.

Business Tax Strategies

If you own a business, MDT Solutions is here to help. It’s important to work with your CPA on annual tax opportunities, and there are long-term considerations too. For instance, did you know that changing the structure of your business could save you on taxes depending on your situation? Many entrepreneurs start out thinking an LLC is the “best” way to organize their firm, but changing to an S-corp or C-corp may help you avoid self-employment taxes and having to pay taxes on net profits. Let’s talk tax strategy.

Employee Retention Strategies

From setting up a 401(k), SIMPLE IRA or other type of qualified plans, as an entrepreneur, you have more tax-advantaged opportunities to plan for your own retirement and provide benefits to attract and retain employees at the same time. We also offer scalable group health plans, with ways to address the rising costs of healthcare and enhance your benefits package with little to no out-of-pocket cost to you or your company using voluntary or supplemental benefits.

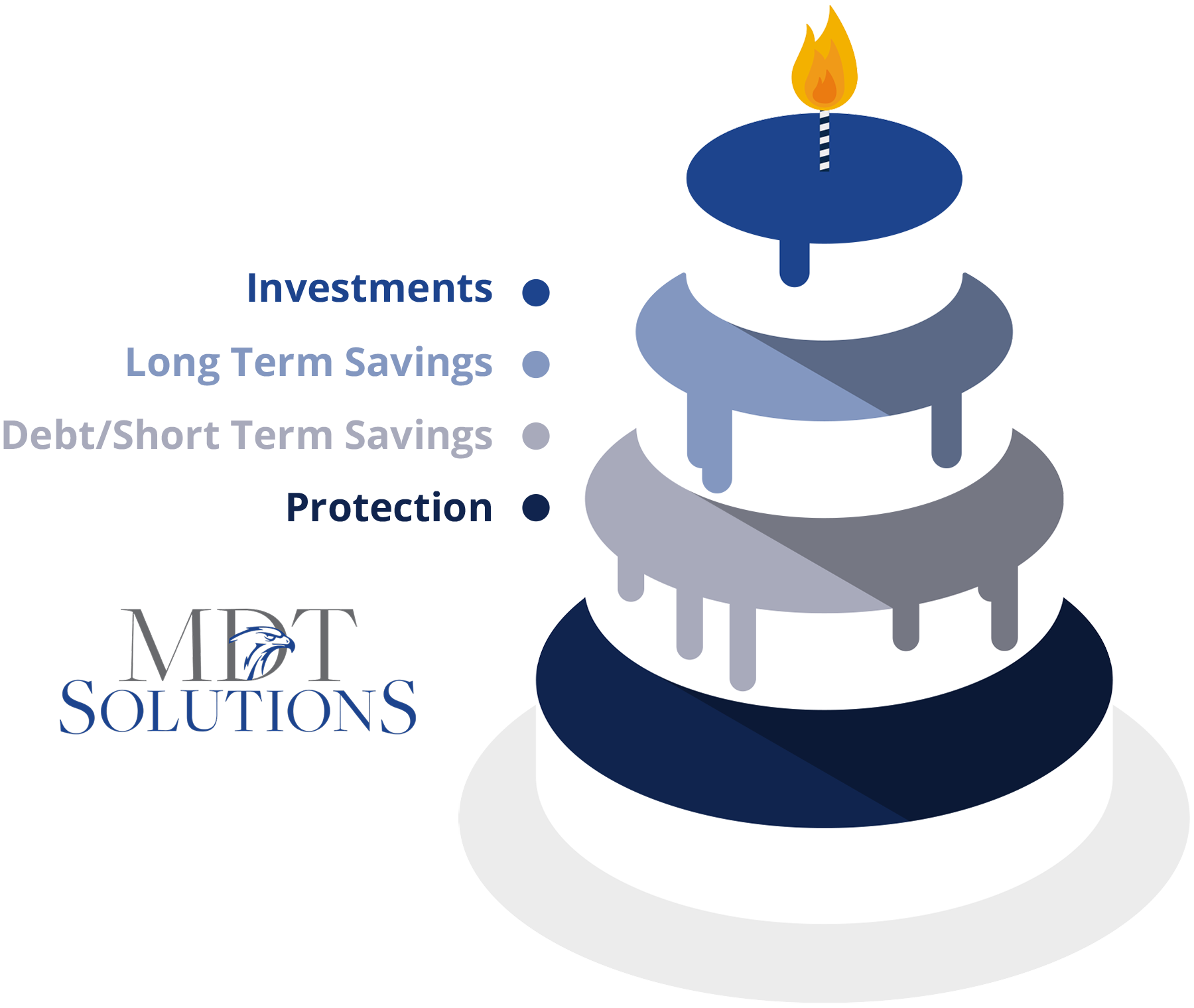

Your Financial Cake

Your finances are layered like a cake, and we believe that the top layers should rest firmly on a foundation of protection from potential loss or adverse life events. Together we will go through all of your assets, determining which are taxable, tax-deferred, or tax-free / tax-advantaged to help you develop a plan and implement strategies to optimize your overall net worth and grow your multigenerational wealth.

Taxes & Your Assets

If you don’t consider taxes, you could have much less wealth than you think. Especially in retirement, you may even end up paying taxes on your Social Security benefits—up to 85%—if you have a lot of money saved in traditional 401(k) accounts, which you must start withdrawing and paying taxes on beginning at age 73 and every year thereafter based on a strict IRS schedule. We emphasize finding ways to mitigate taxes for individuals, families, and businesses.

Taxable

Tax-Deferred

Tax-Free Or Tax-Advantaged

Resources

We’re here to answer questions and provide help when it comes to managing, saving, investing, growing, and protecting your wealth. Browse through the educational resources on our website to learn more. We invite you to read, watch, download, and learn about the basics of finance and retirement. And remember, we are here to help you develop and implement your own personalized plan.